4th April 2025

Changes to Inheritance Tax Liability

Inheritance tax (‘IHT’) planning is a crucial aspect of wealth management, particularly for those who hold assets that currently benefit from inheritance tax (‘IHT’) reliefs.

Two significant potential changes to IHT rules could have a profound impact on UK estate planning:

- The reduction of Business Property Relief (BPR) on AIM shares

- The inclusion of pensions within an individual’s taxable Estate for IHT purposes

At present, shares in certain Alternative Investment Market (AIM) companies qualify for 100% Business Property Relief (BPR) if they have been held for at least two years. This means that, on death, these shares are exempt from IHT, provided the company meets the necessary trading criteria.

Furthermore, pension funds currently sit outside the estate for IHT purposes. This means that when an individual dies, their pension can be passed to beneficiaries tax-free (if the individual dies before age 75 and has not crystallized their pension) or subject to income tax at the beneficiary’s marginal rate (if the individual dies after 75 or is younger but has crystallized their pension).

This has made AIM shares and large pension funds a highly attractive IHT planning tool, perhaps by accident rather than design, as investors can reduce their taxable estate while still maintaining control over their investments.

Example

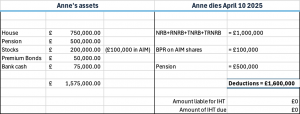

If we consider the circumstances of Anne, a widow with two children who was left her husband’s entire Estate when he passed away 5 years ago. Anne now solely owns a house worth £750,000, stocks worth £200,000 (£100,000 of these in AIM shares), premium bonds worth £50,000 and bank accounts worth £75,000. She also has an uncrystallized pension fund worth £500,000.

If Anne was to pass away next week, she would benefit from hers and her late husband’s full Nil Rate Bands (NRB) and Residential NRBs. She also gets full BPR on her AIM shares and her pension is considered to be outside of the Estate for IHT. Her estate’s inheritance tax liability is zero.

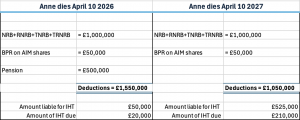

However, the Government’s new proposals, expected to take effect in April 2026 and April 2027, will bring notable changes to her inheritance tax. From the 6th of April 2026, AIM-listed shares will now qualify for only 50% BPR relief, regardless of value.

If we look again at the example of Anne’s Estate if she was instead to pass on the 10th April 2026, her estate’s inheritance tax liability will have changed. Anne will still benefit from both her and her late husband’s full NRBs and RNRBs, and her pension is still considered to be outside of the Estate for IHT, however she now only receives 50% BPR on her AIM shares. This increases her estate’s inheritance tax liability to £20,000.

When further changes to the taxations of pensions are introduced in April 2027, this will increase Anne’s estate’s inheritance tax liability further. Defined contribution pensions will now be subject to inheritance tax, the standard rate of which is 40%. If Anne was to pass away on April 10th 2027, although she will still benefit from her and her late husband’s full NRBs and RNRBs, she now only receives 50% BPR on her AIM shares and her pension is considered to be part of her Estate for IHT. Her inheritance tax liability has increased to £210,000.

In just two years, Anne’s inheritance tax liability has increased from zero to £210,000. With these changes being brought into force, inheritance tax liabilities could increase significantly for many individuals. Those who historically have relied on these assets for IHT planning should review their estate plans and contact Edward Walter for advice on 01892 502 320 or at ewalter@bussmurton.co.uk.